Digital Securities Lab

We help you

Discover | Grow | Collaborate | Build

What is Digital Securities Lab?

Digital Securities Lab is a team of forward-thinking professionals working to help our clients build and leverage opportunities emerging within the decentralized capital markets.

It’s for leaders that are eager to collaborate and actively engage in the digital transformation of capital with their industry peers.

All participants in the market bring a unique perspective, but they all benefit from common knowledge and experiences:

- Enriched education

- Professional networking

- Interactive collaborations

- Access to powerful tools and resources

The successful execution can be accelerated when surrounded by an engaged community of advanced thinkers and practitioners helping you advance your initiative.

Online Community

A private, online network where you can interact, engage, and collaborate with like-minded industry experts & professionals!

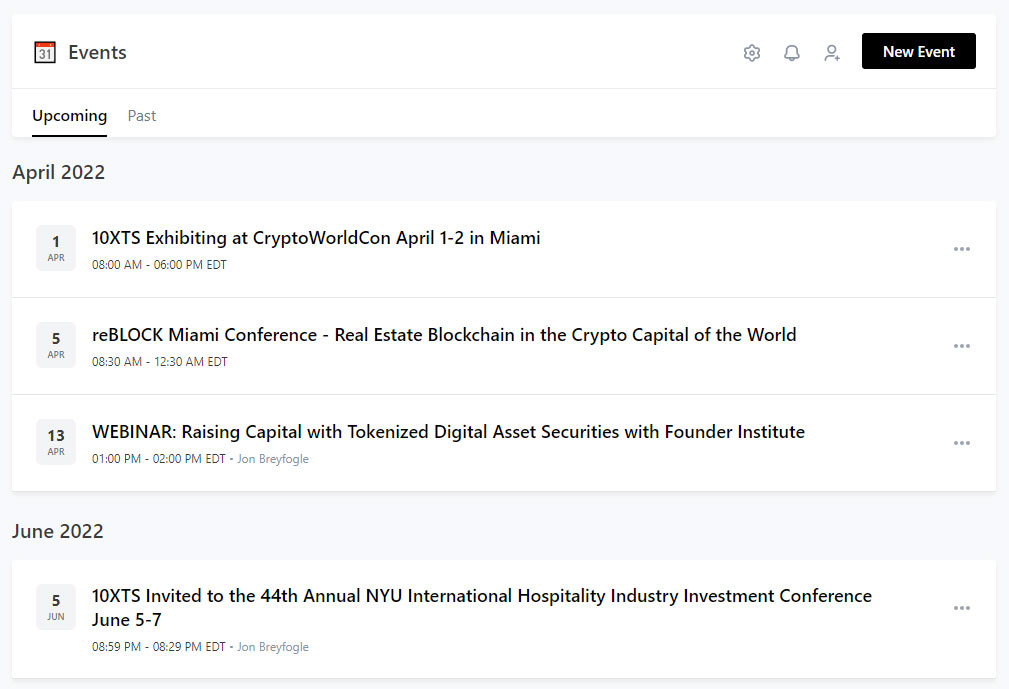

Webinars & Workshops

Focused on industry expertise, project case studies, innovation showcases, best practices, project management, and more!

Resource Library

A community-built library of resources to help develop digital securities, & industry standards!

Who is Digital Securities Lab for?

Securities Issuers and Investors

Join with other securities issuers & investors who are creating programmable digital asset securities!

Capital Markets Providers

Discover new opportunities with the emerging global decentralized capital markets ecosystem!

Bankers and Custodians

Find new opportunities in the tech-driven digital capital markets for traditional financial services.

Legal & Compliance Professionals

Interact with legal professionals who have an interest in digital assets and securities and compliance!

Regulators & Policymakers

Connect with emerging technology development & track industry policy discussions & needs!

Technology Professionals

Build new fintech and regtech solutions for decentralized capital markets and securities.

A Knowledge-Based Collective

The need for a collaborative space to provide discovery, development, and advancement of technology-driven transformation of how we issue, manage, list, trade, and settle securities has never been more important. That culture and commitment is the core of Digital Securities Lab.

Our community benefits:

- A collaborative place to ask questions, experiment with ideas, engage with peers, and grow without fear of judgment or rejection.

- Relationship-building opportunities with successful industry peers and partners that can yield solutions to problems, provide accountability, and establish friendships.

- Premium and discounted access to new courses, content, and other offerings from the founders.

- A community that welcomes members from diverse backgrounds including race, ethnicity, gender, orientation, neurodiversity, and physical ableness.

- A focused environment to accelerate learning and networking due to the absence of noisy conversations and immature colleagues.

- A privacy-first attitude toward all aspects of the community (which is why we built it independent of any mainstream social media platform).

Built on 3 Core Pillars:

#1 - Engaging as a Community

- Community newsfeed for broad-based conversations and interaction.

- Sharing channels for members to share their content & big wins.

- Private channels for laser-focused discussions.

- Direct messaging to promote 1:1 member connections and relationships.

#2 - Sharing Education & Knowledge

- Webinars & Workshops every month we feature a special guest from inside or outside the industry for an intimate 90 minute conversation.

- Tutorials to learn more about digital asset security tokenization, securities, market infrastructure, regulatory compliance, and technology.

- Courses & Challenges Discounted courses, exclusive resources, and group challenges to help members learn and grow in unique formats.

- Gamified Incentives to create and share knowledge throughout the industry.

#3 - Building Industry Relationships & Support

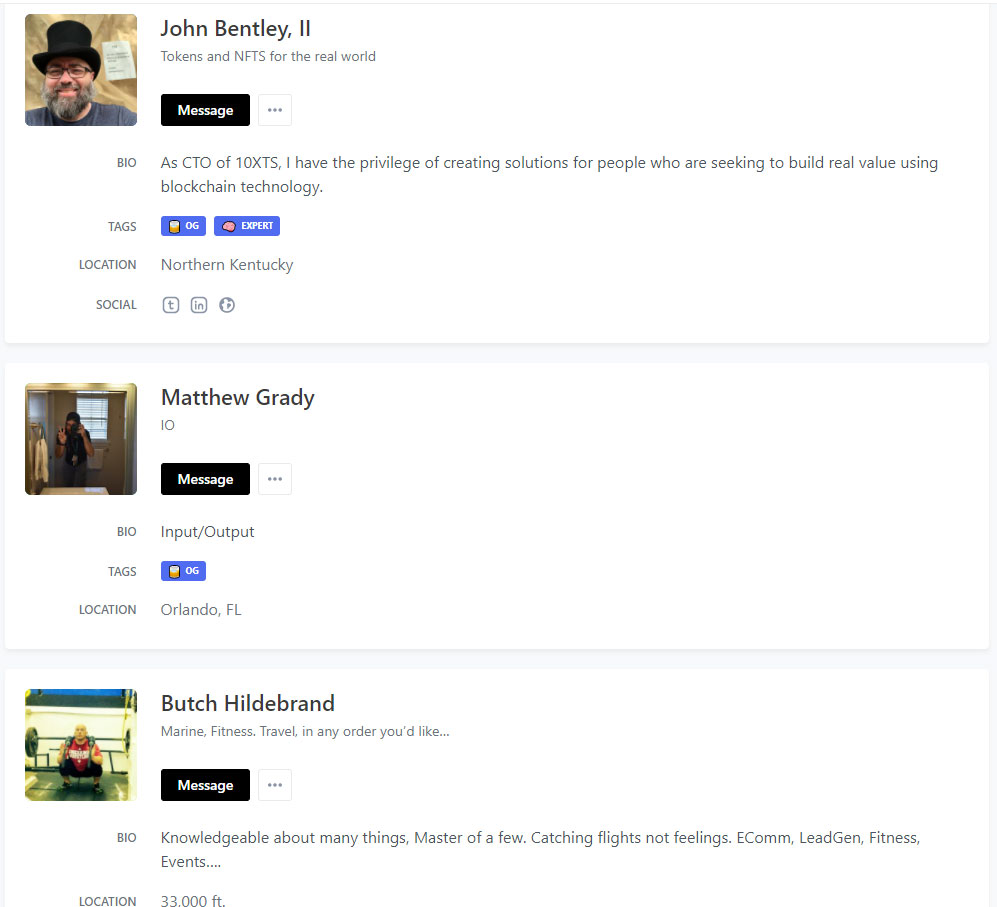

- Industry SMEs & Service Providers who are unafraid to explore the boundaries of technology disruption and enablement.

- Joint Ventures and collaborative development of large scale projects.

- Technology and architecture advisory to ensure the outcomes match the buzzwords on the font end.

Growth-Minded Professionals Wanted

Lifelong learner. Committed to growing personally and professionally. Eager to collaborate and connect. If that sounds like you, and you’re looking for a community of peers to join forces with, we’d love to have you.

Let’s see if Digital Securities Lab is a good match:

It’s a match if you…

- Believe in the virtues of humility, empathy, and abundance.

- Value diversity and accept others regardless of their appearance, ideas, and backgrounds.

- Need and want a group of growth-minded advisors to help, challenge, and encourage you.

It’s NOT a match if you…

- Maintain a scarcity mindset and are more of a taker than a giver.

- Prefer to surround yourself with people who look, think, and act like you.

- Believe that Wall Street 1.0 values and silos of monopolistic information and yield will persist, and further shape the ethos in conflict with the beneficiaries of a decentralized capital market ecosystem

Feel Like It's a Match?

Still have questions?

While you must participate in some way with the digital securities industry, we welcome issuers of securities, investors, capital markets intermediaries, broker-dealers, institutions, exchanges, banks and custodians, legal & financial professionals, and regulators & policymakers.

Our typical member is a lifelong learner with the following attributes:

- High Fluid Intelligence – Someone’s ability to quickly learn a rule set and apply the learned logic to solve novel problems

- Moderate Agreeableness – To be a contributing member, you must exhibit cooperation vs. antagonism, which means effective communication even in the midst of disagreement

- High Openness – Someone’s creativity and their propensity to accept risk and challenge accepted norms

- Other Traits – Including Emotional Intelligence, Stability, Industriousness, and more

They’re lacking a support system or exhausted by the chaos of social media and in search of safe, diverse, and constructive conversations.

Most importantly, they’re passionate about collaborating with and learning alongside their peers while building the industry.

Some members have decades of experience. Others are in the early stages of their career.

The community is made up of:

- Issuers of securities interested in launching a programmable, digital security as as regulatory-compliant token

- Real estate professionals wanting to fractionalize ownership of real estate assets

- Private equity and venture capital professionals looking for deal flow and liquidity for their LPs

- Family Office and HNW investors contemplating a strategic play in the market

- Retail and Institutional investors who are looking into digital securities as an emerging market

- Alternative Trading Systems and Exchange operators looking to build market infrastructure for listing and trading

- Banking and custody service professionals working to provide Banking-as-a-Service solutions to emerging markets

- Legal and compliance professionals working to develop efficiencies through automation

- Regulators who want to ensure consumer protection and mitigation of risks to stable, sound markets and practices

- Technologists working in web3, fintech, regtech, and blockchain who are building solutions for the industry

- Cryptocurrency & NFT enthusiasts who recognize the importance of governance, risk, and compliance

- Multi-billion dollar firms, $0 AUM firms, and everything in between

So what is the common thread between members?

The desire to grow with a community of like-minded peers who:

- Have an abundance mentality

- Want to advance the industry-wide adoption of digital asset securities and capital markets

Like our peers, we see other organizations in the industry as collaborative partners, not competitors. The industry is far too nascent to claim any manner of “leader” in any segment of decentralized capital markets. We are fans of anyone moving real-world assets onto blockchain technology stacks, with trillions in AuM ahead of us with too little subject matter expertise to meet the coming demand.

This is somewhat contrary to the traditional approach to siloed walled gardens in financial markets, which has led to the monolithic, antiquated legacy, centralized infrastructures that exist today.

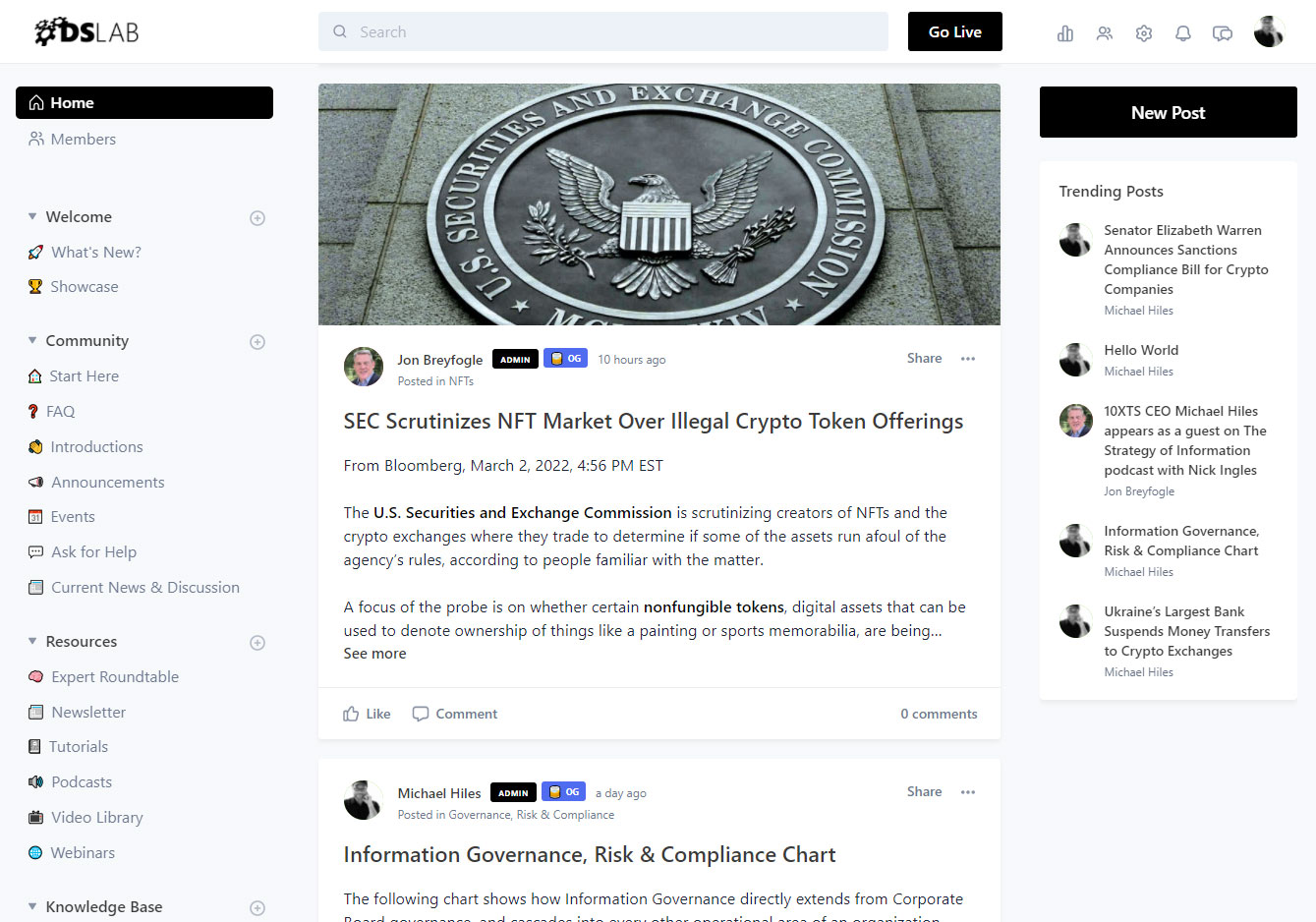

Digital Securities Lab is an online, web-based application. Think Facebook meets Twitter meets Slack… but completely private and distraction free.

We will be launching native iOS and Android mobile apps soon.

NO! It’s free!